By Preeteesh Peetabh Singh

Dialog Reporter

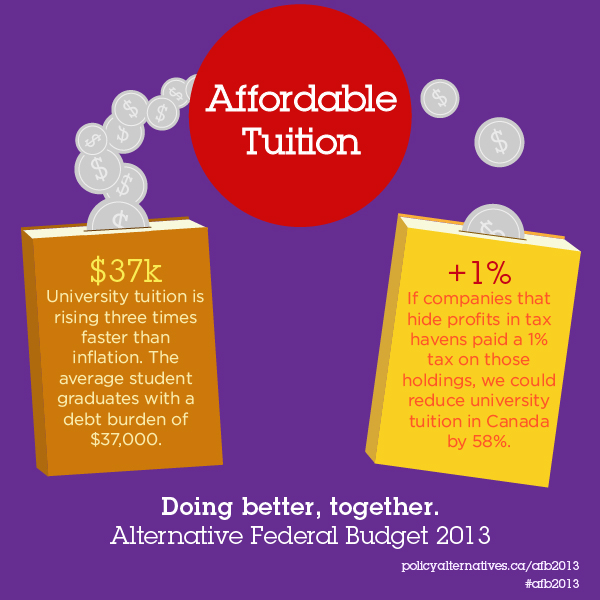

Alternative Federal Budget Infographic courtesy of the CCPA.

The Canadian Centre for Policy Alternatives (CCPA) released its 19th annual Alternative Federal Budget: Doing Better Together (AFB) on March 12.

The AFB counters the views of Finance Minister Jim Flaherty’s Economic Action Plan 2013 on implementing cuts to decrease deficit and balance the books by 2015. It rather focuses on government spending which would result in higher growth, job creation and even balancing the books within the same timeframe.

This year’s AFB consists of 27 chapters written by over 90 contributors that look at everything from first nations reserve issues to child care to international development. Each of these chapters includes specific policy recommendations, costing them all together and putting them in a macroeconomic framework to determine the impact of each program on national deficit, national debt and employment.

According to David Macdonald, the Alternative Federal Budget’s coordinator, some policies that were put in the AFB have found their way in the actual budget in the past. During the stimulus budget just after the recession in 2008, some of the options and recommendations were incorporated into the federal budget such as support to low-income seniors through Guaranteed Income Supplement. It was something that the CCPA had advocated for a long time.

Macdonald said, “Our goal isn’t that everything we have in the AFB, gets implemented in the federal budget. But more so to point out that there is a whole variety of useful programs that we could implement in Canada and pay for them without dramatic increases in taxes or by bankrupting the country.” He cited a national $10 childcare program and pharmacare programs where no one pays over the counter for drugs as doable programs, which have been costed out in the AFB.

“The AFB is in some ways, an idealized view of the progressive world that we could have, but it’s also very practical and it shows how we could go about implementing these programs,” said Macdonald.

This year the AFB has a big focus against “growth-killing” austerity, which is replaced by a plan that strengthens the economy and eliminates the deficit by 2016. The plan includes reduction of poverty and inequality by investing in child care, affordable housing, income supports and post-secondary education. It aims to tackle the First Nations housing, drinking water and education; implementing a long term plan in infrastructure; and lowering the unemployment rate to 6 per cent by 2014 by creating 300,000 jobs.

Talking about “growth-killing” austerity Macdonald said, “One of the problem with that is when you are in a slow growth environment like you are in Canada, the government austerity becomes a part of the problem, not the solution.”

Where does the money come from? The AFB includes a new top personal income bracket, closes the tax loopholes like treatment of stock options and corporate meal entertainment deductions. It brings out some of the dead cash on the balance sheet by raising corporate tax cuts to pre-crisis (2008) rates. The AFB also introduces a withholding tax on money held in tax havens, inclusion of financial transaction tax and inheritance tax on estates over $5,000,000.

Download the CCPA’s Alternative Federal Budget for free at http://www.policyalternatives.ca/afb2013